Posts

If the count are higher, the brand new renter can be file a regular municipal situation inside fairness Court. Landlords must https://mrbetlogin.com/grizzly-gold-mobile/ come back one remaining portion of the protection deposit in this 1 month on the termination of the rent having a keen itemized list of damages, if any. Landlords need to return a security deposit which have attention to the occupant having a keen itemized list of injuries no later on than just thirty days pursuing the termination of your rent.

If i perform owe charge, lease or wreck expenses, should i pay they directly to the newest Flat Community?

One last but popular real question is whether you can withhold put fund if just in case a renter vacations their book very early. So long as you to records is offered, landlords is actually blocked out of asking the newest renter costs due to their animals. Immediately after examining both advice above, it’s obvious exactly how deposit laws and regulations might look very different away from county to say.

If your occupant performed no problem

(1) Within 45 days pursuing the avoid of one’s tenancy, the newest property owner shall return the safety deposit to the occupant along with her with simple focus that has accrued during the each day U.S. Treasury give bend speed for example season, at the time of the original business day of each and every seasons, otherwise step 1.5% a year, any kind of is higher, shorter any injuries truly withheld. Based on in which their leasing house is discover, there is varying regulations about how exactly much money might be recharged to have a safety deposit. Extremely common to possess truth be told there to be an optimum deposit welcome of just one otherwise a couple months’ book however states haven’t any particular laws and regulations. If a property owner does not go back the protection put, the newest occupant is document a conflict in the Small claims Court in the event the the level of injuries is actually below $500.

A regular contributor so you can money.com.au, Mansour has continued to develop a deep comprehension of varied funding steps, providing him to provide valuable, well-informed viewpoints to the business style and you may possibilities. With over twenty years of experience in australia’s a home field, Mansour has established work specialising from the acquisition and you will selling away from funding and commercial characteristics, comprising major metropolitan hubs and you can regional components. Since the inventor and you will manager of a money brokerage firm, he takes care of that loan portfolio exceeding $a hundred million while you are helping a standard listing of subscribers across the country. For many who’lso are to buy having less than a great 20% deposit and you can don’t features regulators backing (otherwise a great guarantor), you’ll have to pay Lenders Mortgage Insurance policies (LMI). They are able to giving difficulty guidance, to alter your instalments, or take a look at refinancing alternatives.

They’ll look at the money, savings, credit history, and borrowing from the bank power to dictate qualification. If this all is pleasing to the eye, they’ll make an application for a location at home Be sure Scheme to your the part. Nevertheless’s not automated – Housing Australian continent has to accept your home on the plan earliest.

- Whatever the state, talk with your own property manager about it prior to they capture legal step.

- If a landlord will not go back the protection deposit in the needed time period, the newest tenant need to posting a request letter and present the brand new property manager 7 days to go back the full protection put.

- Whether or not a resident won’t shell out, we’ll leave you all of the ammunition and you may research wanted to evict.

- If they have obviously generated a work to go back your house within the a good, clean position, don’t fees him or her needlessly.

- Certain states as well as mandate commission away from renters’ courtroom fees if your court laws and regulations in their like.

No-claims so you can file

F. But as the if you don’t provided with the newest local rental arrangement, an occupant should perhaps not use otherwise subtract any portion of the shelter deposit on the history week’s rent otherwise fool around with or apply such tenant’s shelter deposit at any time rather than fee away from book. The newest unlawful retention out of a security put inside admission of this chapter produces a property owner accountable for twice as much of that portion of the shelter put wrongfully withheld from the tenant, as well as reasonable lawyer’s charge and court costs. (2) Furnish to your renter a composed itemized list of the brand new damage by which the safety put otherwise people piece thereof is withheld, as well as the equilibrium of one’s defense deposit. The brand new property manager will have complied with this particular subsection by emailing including report and one fee to your last identified target of your occupant. Landlords need get back one kept portion of a security deposit and you will itemized declaration of write-offs, or no, zero after than just 21 months after the tenants flow-away or try evicted regarding the leasing device.

A security put is an additional sort of protection to have a property owner to find one fund expected out of evicting a citizen. In a number of claims, it currency can be accumulated to deal with any possessions destroy up on venturing out. Defense deposits may vary out of one state to another, which’s necessary to understand regulations near you. Ask them to have a keen itemized checklist that explains why he’s not returning the security deposit.

Whenever Must a property manager Come back a renter’s Shelter Deposit within the Michigan?

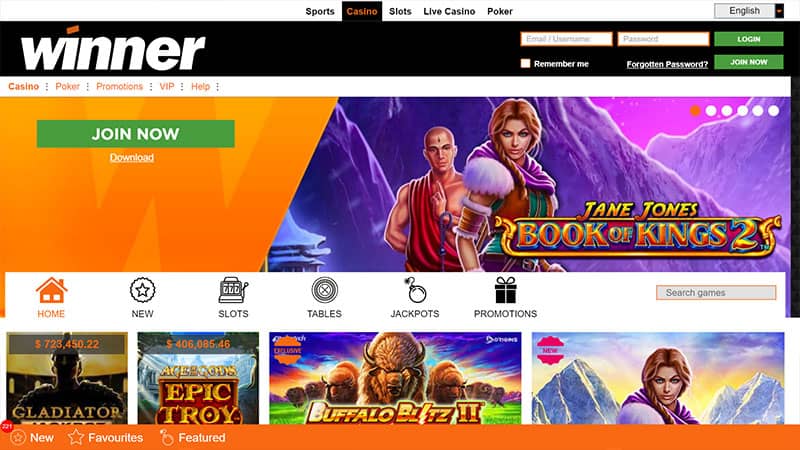

To assist your next perform, you will find recognized the 5 better online game to play to the $5 gambling enterprise deposit bonus. You should buy an inexpensive money boost by picking certainly the new advertisements in the secure gambling enterprises in the table. Those web sites as well as their bonuses was thoroughly vetted from the all of our pros and have been considered an educated to possess $5 deposit offers. A sensible way to maximize an excellent $5 minimal deposit is to find your path on the each day, a week, or month-to-month leaderboards. This type of tournaments along with other participants will often have a contributed prize pool giving away, between $50 so you can $150. A great $5 deposit extra try best if it produces a great pre-place number of totally free revolves of ten so you can two hundred.

Unlike in some most other claims, landlords inside Arkansas do not are obligated to pay focus to the shelter dumps. We have found a basic writeup on the brand new apartment protection put laws and regulations for every United states county. A review measures up the property’s present state to help you their move-inside condition, usually recorded inside a research otherwise listing. Such as, small scuff scratches would be sensed typical wear, if you are damaged fixtures or high holes you will validate write-offs. Files, including the first examination report, is important within the fixing disagreements.

Accumulated interest need to be paid so you can clients month-to-month or a year within the the type of a primary percentage otherwise a cards up against lease. The new property owner need choose from the 2 ways of payment and you may notify the newest renter on paper. (i) any delinquent rent or water charge having maybe not already been validly withheld or subtracted pursuant to the standard or special rules.

The maximum amount a property owner may charge to have a security put in the DC is equal to a month’s rent. Thus in case your month-to-month rent is actually $step one,500, the new landlord may charge up to $step one,five hundred because the a security deposit. Keep in mind that the safety deposit is not sensed rent and cannot be employed to pay-rent within the rent label. DC Security Deposit Restrictions and you may Work deadlines – Are you currently a renter within the Arizona DC wondering regarding the shelter put limitations and due dates? Or at least a property owner looking to clearness for the courtroom standards to own defense dumps? So it biggest guide provides you with everything you need to learn about DC defense deposit laws and regulations.

Since the a great monies try repaid on the Flat Neighborhood, you will have no responsibility to the Surety. This really is our very own entire agreement, and i am perhaps not counting on people dental pledges or statements. Look at the lease prior to making people alter to the property, such as color the fresh walls. If the change isn’t greeting, you will probably need to heal they to your brand-new reputation after you get-out.

The new put fund will likely be subtracted to possess solutions beyond normal don-and-rip, book violations, and you may clean up can cost you. Most claims ensure it is landlords in order to charges whatever they assess because the reasonable to own a protection deposit. Nevertheless, most condition laws and regulations caps so it at the a deposit of just one few days’s rent. That it deposit really stands while the a financial support if the renter damage the new flat or default for the lease.

By the information and you will planning these additional can cost you and charge, homebuyers can also be be sure a smoother and a lot more economically in check house-to buy experience. Home buyers can select from individuals financing payment choices, and fixed interest rate, variable speed home loan, or a mixture of one another. A predetermined interest offers balances with uniform money, when you’re an adjustable speed mortgage provides independency plus the possible to benefit out of straight down industry interest rates.