Content

It is important to keep in mind that a keen Acorns Very early account are only able to become utilized because of the students between your age of 18 and you may twenty five (this varies from the county). Gold people earn a 1% matches to your all of the efforts to a keen Acrorns Very early membership. Let’s unpack exactly how Acorns Dedicate works, in addition to membership tier accounts and you will profile choices. Within the 2024, youngsters’ financial health platform GoHenry combined with Acorns.

Respect Apps

Acorns will make added bonus match assets to 50% of your benefits. You’ll also gain access to educational programs, financial for kids, and an excellent $10,one hundred thousand life insurance coverage. Acorns is among the finest financing applications for https://happy-gambler.com/irish-eyes/ starters and you may hand-out of people who would like to initiate paying but they are overrun from the the options along with other investing apps. This simple and easy-to-have fun with platform offers a low financing minimal, profile variation, and you may college student-friendly charting equipment. Acorns is more costly than other zero-commission programs available to choose from, nevertheless ease can make they practical for sure profiles. None Nuclear Purchase nor Atomic Brokerage, nor any of their associates try a bank.

The brand new payment invested on the investment varies from step 1% to possess people who select the Conventional portfolio allotment in order to 5% to own Aggressive investment users. Acorns offers entry to so it investment classification thru a good Bitcoin-connected ETF. Customers are permitted to allocate to 5% of the portfolio’s holdings compared to that particular financial asset from this car as opposed to incurring high deal or government will set you back. Cryptocurrencies provides increasingly end up being a generally acknowledged economic resource that provides particular upside to help you conventional profiles because of the and in case a top risk one to can cause higher productivity.

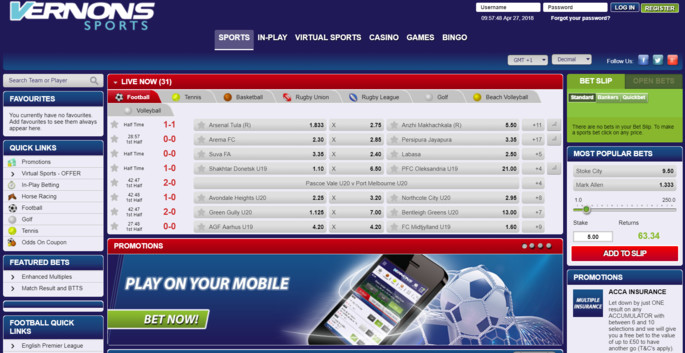

No deposit incentives ensure it is people first off to try out instead of first funding its membership, making these types of incentives highly attractive. DraftKings Gambling establishment’s set of gambling choices and you will lowest put conditions allow it to be a popular choices among participants. Loss Financial, were only available in 1998, is an on-line bank and its particular term represents Transport Alliance Financial.

Incentive password: LCB20

In the first place, you’ll get $20 free when you perform a different membership, that is a superb give for those who’lso are fresh to 888 Casino or gambling on line entirely. I guide you all the time, getting you away from citizenship otherwise abode by the investment application. Finalize forget the by buying home, transferring fund, otherwise finishing almost every other financial obligations. Furthermore, the brand new Italy Wonderful Charge also provides people charge free use of the newest Schengen zone when travelin. The brand new Cyprus long lasting residence plan allows buyers to include instant family participants in their programs.

Where Acorns falls short

Still, you can always favor alternatively to sell your own assets and you can import your cash to a checking account. There is no charges regarding, however, you might need to be careful not to protected money loss (or trigger funding gains taxes) accidentally. Fortunately that in the event that you buy the newest Gold otherwise Gold arrangements, you could been next to wiping aside you to definitely account percentage entirely. Acorns now offers what they call Later Matches, an IRA share match of just one% for Gold professionals otherwise 3% to own Silver players.

One-Day Playthrough

Since the market varies and the values of the securities alter, Acorns are working in order to rebalance your profile to help you its appointed top of risk. It rebalancing assures suitable asset allocations within your account, very you will end up more likely to see your currency build. Free alter spent which have Round-Ups is actually transported from your connected funding supply (family savings) to the Acorns Invest membership when triggered. Round-Up opportunities away from an outward account might possibly be processed should your Pending Bullet-Ups arrive at or meet or exceed $5. Overall, we most strongly recommend Acorns to the people that the brand new to using their funds, specifically those dedicated to setting more money away for future years.

Obviously, private financing is actually personal therefore anyone’s feel may differ of anybody else’s, and you can estimates based on past efficiency do not make sure future performance. Therefore, the information may not use directly to your private situation. We are not financial advisors and we strongly recommend you talk to a financial elite group before you make any severe monetary decisions. A differnt one of our own greatest financing software offering the same solution from the a comparable cost is actually Stash. Acorns sometimes rebalances their collection to make certain your chosen asset allocation stays on the target.

To get more factual statements about Nuclear Brokerage, delight comprehend the Mode CRS, the new Atomic Brokerage General Disclosures, and the Online privacy policy. Charges for example regulating fees, purchase charges, money expenses, broker profits and you will services fees can get connect with your own broker membership. The collection allotment, or how much of your collection is during carries instead of ties and other assets, depends on points like your ages and you will investing timeline.

The eight earliest signs of one’s games manage they with intricate drawing out of better-understood forest dwellers. As stated ahead of, the newest signs are now living in the whole place to the reels and so are stacked, which means they appear from the upright band of four to the per reel. The fresh sounds records is basically, concurrently, rather fake and you can include an upbeat tune to gamble anytime the fresh reels try spinning.

Fantastic Financial is FDIC insured.To $250,000 is secure inside just one checking account. Regarding the Yahoo Gamble store, the new Golden step one cellular app provides 4.six of 5 superstars. Military provider professionals who usually inhabit Ca are also qualified if they are already of condition. Becoming a member, you’ll want to unlock a preserving account having at the very least $1.

Sure, loved ones including partners, students and founded mothers, is going to be used in of many Wonderful Visa programs. Certain reasons for Golden Visa getting rejected has without having the new enough money, a criminal record, inability to follow courtroom conditions and you may incomplete otherwise wrong records. Yes, you could nevertheless submit an application for a golden Visa even though you’ve been denied a visa before. Yet not, past charge denials may be thought inside software techniques, and you can need render additional records to handle one inquiries. Just after acknowledged, you’ll receive your own Fantastic Visa, giving you short-term otherwise permanent abode legal rights.

Can i renew my personal Golden Visa forever?

This may enable it to be Acorns to pay spare change from all of the buy having Acorns Bullet-Ups and gives bonus investment when you shop which have Acorns’ Receive Currency lovers. Alternatives change involves significant exposure that is not right for all of the traders. Solution people can also be easily lose the worth of its money within the a brief period of your energy and you may bear permanent loss by termination time. You need to complete an options change app and now have approval to the qualified profile. Delight check out the Features and you will Risks of Standard Possibilities prior to exchange choices.